For international sales, tax is inevitable, and that’s the same in Magento 2. Magento tax is one of the issues that are very concerning when retail businesses using this platform. And if you are looking to learn about Magento 2 tax, specifically Magento VAT, then you have come to the right place. This article will give you basic information about Magento 2 VAT and the VAT fields that you should know.

Table of contents

What is VAT in Magento 2?

What is VAT?

VAT (value-added tax) is an indirect tax and is charged on the added value of goods and services arising from the process of production and circulation until they reach consumers. People calculate VAT according to percentage of the price, which means that the actual tax burden is visible at each stage in the production and distribution chain.

Value-added tax originated from France – the first country to promulgate the Law on Value-Added Tax in the world in 1954. Currently, people are using VAT in most countries of the world (about 130 countries).

VAT in Magento 2

After reading the concept of VAT, we can see that Magento 2 tax has never been interesting and that calculating, collecting, and paying Magento 2 VAT requires a lot of calculation and knowledge of the law. Moreover more countries you sell to, the more confusing the problem becomes.

So Magento has provided a Configuring Value Added Tax (VAT) backend for Magento 2. Configuring Value Added Tax (VAT) is a great solution to solve the conflict of Magento 2 VAT collection methods. That will depend on what regions your store is located in and whether the goods you offer are products, materials, or services. With the Magento 2 VAT function, you can create a data management table containing your country, Magento 2 VAT rate, customer type, etc. Keep reading to learn more about Magento 2 VAT, we will also provide you with commonly used Magento 2 VAT fields, configuration settings, and VAT ID Validation.

| Relates articles: Magento Taxes: Everything You’d Wish To Know What is Magento WEEE and what should you know about it? What is Avalara Magento 2 and what does it do? |

VAT ID Validation

VAT ID validation automatically calculates the required tax for B2B transactions taking place among the countries of the European Union (EU), relied on the seller’s language and the customer’s address. Therefore commerce performs VAT ID validation using the European Commission server web services.

- VAT is charged if the seller and customer are in the same European Union country.

- VAT is not charged if the seller and customer are in different EU countries and both parties are registered business entities in the European Union.

The store owner will create default customer groups to automatically assign to customers during account creation. As a result, different tax rules are used for domestic (domestic) and intra-EU sales.

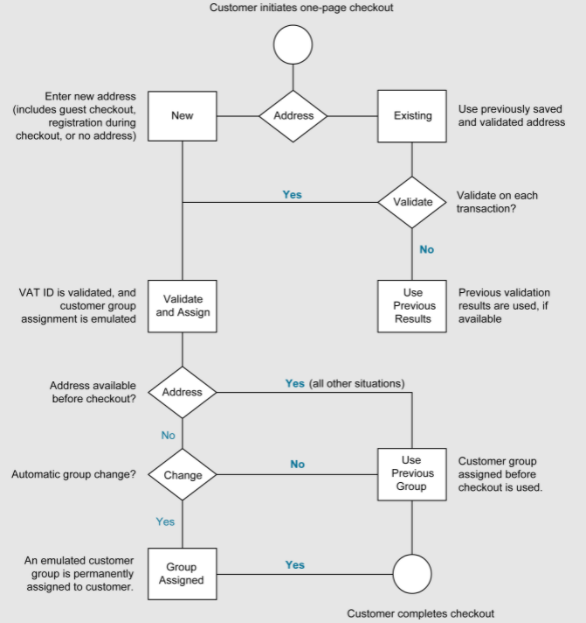

Customer registration workflow

When VAT ID Validation is enabled, after registration, each customer is suggested to enter a VAT ID number. However, only Magento 2 VAT registered customers can fill in this field.

After the customer has selected the address and provided the necessary fields, then the system will send a request for VAT ID validation to the European Commission server. One of the default groups is assigned to a customer according to the validation results. If the customer or administrator changes the default address’s VAT ID or changes the default address altogether that group will be changed. You can change the group temporarily in some cases during a single-page test.

If enabled, you can override VAT ID Validation for each customer by choosing the check box on the Customer Information page.

Payment workflow

If the customer’s VAT validation perform during the payment process, Magento will save the VAT claim identifier and VAT claim in the Order Comment History section.

The Validate on Each Transaction setting will not apply if the customer uses a 3rd party payment method. So during the checkout process, the customer group cannot be changed.

VAT fields and Magento configuration settings you need to know

Commerce uses the following VAT fields and configuration settings to address different scenarios:

Merchant Information

Stores > Configuration > General > General > Store Information

| VAT Number | This is a VAT number which is assigned to the seller. |

| Validate VAT Number | This is a VAT Number that VAT validation confirms if it matches the corresponding record in the European Commission database. |

Customer Information

Customers > All Customers > Edit

Account Information

| Tax/VAT Number | Sellers will be assigned a value-added tax or tax code number if applicable. |

Addresses

| VAT Number | If applicable the addresses of each individual customer are associated with a value-added tax number. If the item is a digital product within the EU, VAT will be charged according to the customer’s shipping address. |

Configure > Customers > Customer Configuration > Create New Account Options

| Show VAT Numberon Storefront | The customer’s VAT Number field will be determined whether it is included in the Address Book available in the customer account. |

| Default Value for Disable Automatic Group Changes Based on VAT ID | VAT ID is an internal identifier for the VAT Number of the customer when used in VAT Validation. Based on the results specified, the customer will be automatically included in one of the default customer groups created earlier. During VAT Validation, Commerce verifies that the number matches the European Commission database. |

Wrapping Up

For your business to grow smoothly, it is very important to have a clear understanding of tax in Magento. And VAT in Magento has tools to help you calculate this value-added tax. After reading this article, we hope you have a basic understanding of value-added tax in Magento.

Optimize Your Magento Store With Powerful Extensions

Looking for fast, efficient and well-coded extensions to build or optimize your Magento stores for sales boosting? Then visit Magezon website and grab necessary add-ons for yours today!

Magezon Blog Help Merchants Build Comprehensive eCommerce Websites

Magezon Blog Help Merchants Build Comprehensive eCommerce Websites