GST is one of the most ambitious and significant indirect tax reforms. Its goal is to levy a single national uniform tax on all goods and services. GST has replaced a variety of central and state levies, transforming countries that apply it into a more integrated national market. The tax net brought more manufacturers in as a result. It can significantly increase revenue by increasing efficiency. As well as spiked government budgets, growth is definitely going to happen by implementing a new tax that covers both goods and services, which Magento 2 GST plays an important part of.

In this article, you are going to learn about what GST is and 6 Magento 2 GST extensions that will help you implement your own GST.

Table of contents

Goods and services tax explanation

GST is a tax on goods and services that includes a full and continuous chain of set-off benefits all the way down to the retailer. It is essentially a value-added tax at each level, with a supplier’s ability to set-off the GST paid on the purchase of goods and services through a tax credit mechanism at each stage. The burden of GST is ultimately borne by the commodity/end-user service’s (i.e. final consumer).

The goods and services tax (GST) is a federal indirect sales tax that is levied on the purchase price of certain products and services. The business adds the GST to the product’s price, and the buyer pays the sales price, which includes the GST. The business or seller then collect and forward the GST to the government. In some countries, people call this the Value-Added Tax (VAT).

The implementation of GST

Since 1954, when France became the first country to apply the GST, an estimated 160 countries have implemented it in some form or another. Canada, Vietnam, Australia, Singapore, the United Kingdom, Monaco, Spain, Italy, Nigeria, Brazil, South Korea, and India are among the countries that have enacted a GST.

The cascading effect on the sale of goods and services has mostly been eliminated by the GST. The elimination of the cascade effect has had an effect on the cost of items. The cost of items reduces because the GST regime eliminates the tax on tax.

Due to being new, GST inherits a lot of technology. The GST onlinesite complete all operations, such as registration, return filing, refund application, and notice response, which speeds up the process.

The majority of countries that have a GST have a single unified GST system, which implies that a single tax rate applies across the board. A country with a unified GST platform collects central taxes (such as sales tax, excise duty tax, and service tax) as well as state-level taxes (such as entertainment tax, entry tax, transfer tax, sin tax, and luxury tax). The tax rate for almost everything is the same rate in these countries.

| More about Magento tax: Magento Taxes: Everything You’d Wish To Know Understanding The Basics About Vertex Tax Best Magento 2 VAT/Tax Exemption Extensions For Your E-Store |

Calculating GST

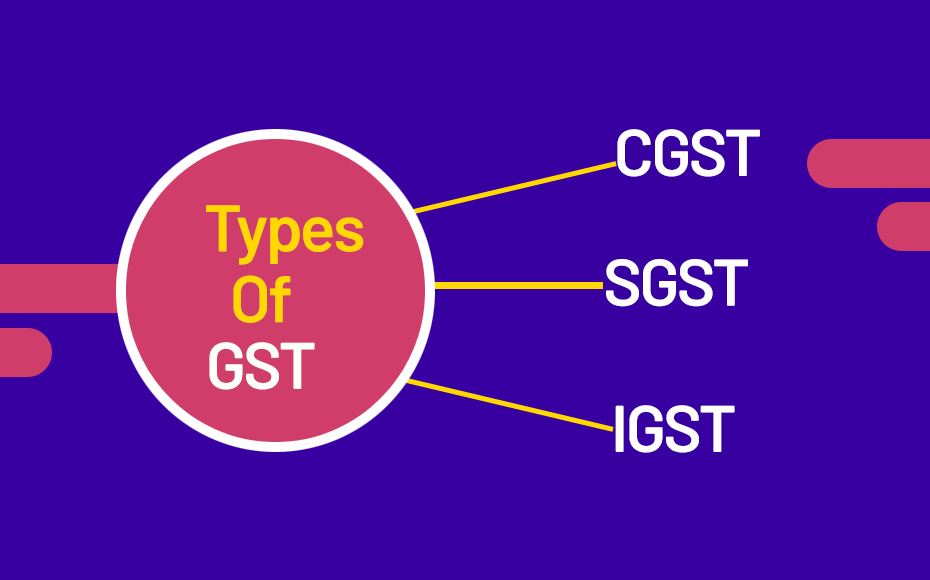

There are three taxes applicable under this system: CGST, SGST & IGST.

- CGST (Central Goods and Services Tax): It is the tax collected by the Central Government on an intra-state sale (e.g., a transaction happening within Maharashtra)

- SGST (State Goods and Services Tax): It is the tax collected by the state government on an intra-state sale (e.g., a transaction happening within Maharashtra)

- IGST (Integrated Goods and Services Tax): It is a tax collected by the Central Government for an inter-state sale (e.g., Maharashtra to Tamil Nadu)

The following formula is one of the most straightforward ways to calcute GST. And this formula below can also compute the net price of a product after applying GST and then subtracting it.

The GST computation formula is as follows:

- Adding GST:

GST Amount = (Original Cost x GST Percentage)/100

Net Price = Original Cost + GST Amount

- Removing GST:

GST Amount = Original Cost – [Original Cost x 100/(100+GST percent)]

Original Cost – GST Amount = Net Price.

Top 6 Magento 2 GST Extensions for e-stores in Indian

1. Meetanshi – Magento 2 GST India

Meetanshi’s Magento 2 GST Extension enables you to make your Magento 2 store GST-ready in accordance with Indian government tax regulations. It calculates and adds GST to your Magento 2 store purchases automatically.

– Price: $44.99

– Compatibility: All Magento 2 product types

– Features:

- Only Meetanshi’s Magento 2 GST extension allows you to effortlessly integrate Indian GST into Magento 2 without any difficulties.

- It allows you to apply GST to select products or the entire store.

- All Magento 2 product types are compatible with the Magento Indian GST extension.

- Allows adding buyer GSTIN (Goods & Service Tax Identification Number) from the frontend. Shipping Address Billing Address

- In all Magento 2 order documents, include GSTIN, CIN (Corporate Identification Number), and PAN (Permanent Account Number) numbers.

- Set the GST rate to compute automatically and apply to product purchases.

- Set the minimum product price at which you can apply the GST rate, as well as the GST rate that will be applied if product prices fall below the minimum price.

And, GST Expansion in India For Magento 2, the default tax class is unimportant, but if you want to avoid charging both the default tax and GST, change the product tax class from “taxable items” or any other tax classes to “none.”

2. CedCommerce – Indian GST Magento 2 Extension

This Magento 2 Indian GST Extension allows you to apply appropriate Indian GST rates to products from various tax slabs. The GST extension displays the tax amount on the front end after properly calculating the tax. GST is levied on a product-by-product basis and across the board.

– Price: $99.00

– Compatibility: All Magento 2 product types

– Features:

- GST appears on the order view, invoice view, credit memo view, new order email, and PDFs with the Magento 2 Indian GST extension.

- The administrator can set The Goods and Services Tax Identification Number (GSTIN), and the GSTIN can be viewed on the invoice and credit menus.

- From the product creation page, the GST extension allows the admin to select the tax rates for the various items.

- Imposed tax classes can automatically calculate the SGST, CGST, and IGST

- To apply IGST, the shipping origin must be different from the warehouse origin.

- When the GST extension is on, the GSTIN shows up on both the invoice and the credit memo.

- When the GST extension is on, the GSTIN shows up on both the invoice and the credit memo.

3. Magecomp – Magento 2 Indian GST

The Magento 2 Indian GST extension aids in the creation and calculation of tax rates and rules, allowing you to make your Magento 2 stores GST compliant.

– Price: $45.00

– Compatibility: All Magento 2 product types

– Features:

- Enable Magento 2 GST for the entire site, each category, and each product.

- To show in Magento order information, enter GSTIN, CIN, and PAN numbers.

- By uploading a CSV file, you can set the GST rate in Magento 2 for various goods.

- Establish whether product prices include or exclude GST tax rates.

- Create a GST report for each order as well as each product as needed.

4. Elsner – Indian GST Magento 2

Elsner’s Magento 2 GST India Extension makes your Magento 2 store GST-ready, in accordance with Indian government tax rules and regulations. It calculates and adds GST to your Magento 2 store purchases automatically. This extension was created to comply with the Indian tax rules’ standard and standards.

– Price: $84.00

– Compatibility: All Magento 2 product types

– Features:

- The GST rate can be set by the administrator.

- The minimum price for the application of GST on products can be determined by the administrator.

- Customers will notice IGST, CGST, and SGST depending on the administrator’s business origin or company location.

- The module can be easily enabled and disabled by the administrator.

5. MageGadgets – Indian GST for Magento 2

The major reason for the GST rollout is to replace all existing separate taxes with a single tax, also known as “One Nation, One Tax.” The Indian GST has compelled e-commerce and online markets to comply with the GST tax as soon as possible and adopt laws in their stores.

Magento 2 Indian GST Extension can be enabled globally. Set the GSTIN number that will appear in all Magento 2 order information. Add a GSTIN number that will appear in various Magento 2 order papers.

– Price: $48.50

– Compatibility: All Magento 2 product types

– Features:

- It is simple to use.

- Admin configuration for inserting the store’s GST number.

- Only the GST-compliant invoice and order templates have been changed.

- GST number is included to all invoice and order emails or pdf files.

- SGST, CGST, and IGST have their own columns.

- All transactional emails and pdf files have SGST, CGST, and IGST calculated and inserted automatically.

- GST columns in order email, admin panel, and order pdf, etc., as per the standard format published by the Government of India.

- GSTIN (buyer level) is provided in the invoice as an option.

6. Tech9logy – Magento 2 Indian GST Extension

This Magento 2 GST extension configures your Magento store to comply with GST laws set forth by the Indian government. With the help of this extension, GST splits (CGST, SGST, and IGST) can be generated in a variety of formats, including invoices, PDFs, orders, and reports. This Magento 2 GST Extension is compatible with any eCommerce transactions, regardless of product type or category. Magento’s taxation architecture of tax classes, rates, and zones makes it simple to set up GST with different tax slabs on online retailers.

– Price: $39.00

– Compatibility: All Magento 2 product types

– Features:

- The GST number can be associated with certain stores by administrators.

- GST-compliant invoices and order templates have been changed.

- All invoice and order emails will include the appropriate GST number.

- Separate columns are used to clearly depict the SGST, CGST, and IGST.

- SGCT, CGST, and IGST will be automatically calculated and added to all transactional emails and PDFs.

- GST columns for order emails have been added to the admin panel and order PDF in accordance with the standard format published by the Government of India.

- Buyer level (optional) The GSTIN is included, as well as the option to display the HSN value on the invoice.

- The word “TAX” can be changed by the word “GST” in all transactional emails and PDFs.

Conclusion

The GST system is the most significant tax overhaul in decades. The fundamental goal of implementing the GST was to remove tax on tax, or double taxation, which occurs when goods are manufactured and then consumed.

With the mentioned Magento 2 GST extensions, you can make taxing an easier process, for both yourself and your customers. Good luck.

At Magezon, we provide many fast, efficient yet affordable Magento extensions that can help you optimize your store and win sales. So visit Magezon to pick ones for yours!

Magezon Blog Help Merchants Build Comprehensive eCommerce Websites

Magezon Blog Help Merchants Build Comprehensive eCommerce Websites